A Leading Player in a Growing Technical Consulting Market

Measured by net sales, Sitowise is a leading Finnish technical consulting company operating in the Nordic technical consulting market. Sitowise’s main emphasis is on the estimated EUR 1.5–1.7 billion Finnish market, which is estimated to grow at an annual rate of 4–5 percent from 2022 to 2025. [1] According to the view of Sitowise’s management, Sitowise is well-positioned, due to its broad competence base, to take advantage of the key megatrends driving the technical consulting market – urbanization, renovation backlog, increasing complexity, digitalization and sustainability.

Sitowise can take advantage of the key megatrends like urbanization, renovation backlog and digitalization.

Broad Technical Consulting Service Offering

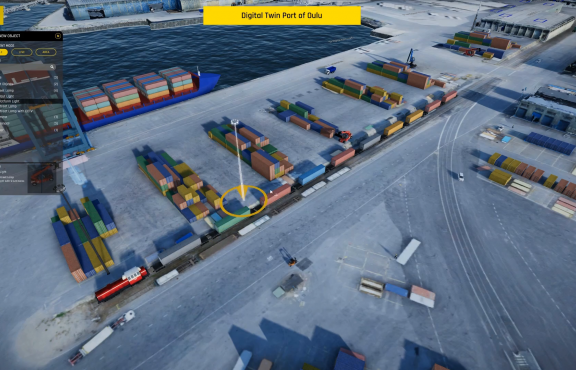

Sitowise can offer its customers comprehensive and multi-disciplinary solutions by combining smart digital solutions with in-depth knowledge of infrastructure and buildings. The company can execute large projects as the sole technical consulting provider, which eliminates the need to hire multiple technical consultants, providing a more convenient customer experience.

Efficient Operations Supported by Decentralized Business Model and Strong IT Platform

Sitowise’s scalable business model enables the efficiency of its operations. This is demonstrated by adjusted EBITA margin of 10.0 percent for the financial year ended 31 December 2022. The lean organization structure and local client presence ensure an efficient decision-making. The decentralized business model with nationwide offices, supported by centralized group services, and two competence centers in Tallinn and Riga serving the Finnish and Swedish buildings consulting enable a lower cost base and a flexible allocation of resources. Sitowise has a highly competitive utilization rate of 76.1 percent. [2] The proprietary digital collaboration platform Voima streamlines workflow management and collaboration in Finland and supports the high-quality of work.

The decentralized business model enables a lower cost base and a flexible allocation of resources.

Sustainability as a Core Part of the Operations

Sitowise has an extensive impact on sustainability through its projects. Sitowise guides its customers to make sustainable decisions and more sustainable choices. In building projects, for example, Sitowise can seek to minimize carbon footprint through optimization of materials selection and structure and systems solutions. In the design phase Sitowise can utilize its knowledge to design energy-efficient buildings which will have a long-lasting impact on emissions. In infrastructure projects, Sitowise can advance sustainability by improving and designing low-emission transport and providing environmental consulting concerning e.g. circular economy. In Digital Solutions, route optimization and planning can lead to decreased fuel consumption.

Broad Customer Base That Provides a Solid Platform for Growth

Sitowise’s customer portfolio consists of both public and private sector customers. Almost half of the net sales come from municipalities and state agencies. The key state agency customer is the Finnish Transport Infrastructure agency, which is responsible for the construction and maintenance of Finland’s road, rail and waterway systems, with an annual budget of EUR 2.1 billion. [3] These public sector customers have historically ensured stable net sales with predictable margins. The other half of the net sales come from private sector customers, and within it the two main customer segments are construction companies and housing cooperatives.

An Attractive Workplace for Top Experts

Sitowise’s success is based on attracting, motivating and retaining the best talent in the field. The ability to offer employees interesting career and professional development opportunities is an important competitive advantage in recruiting and retaining top experts. The cornerstones of Sitowise’s entrepreneurial culture include honesty, openness, teamwork and well-being. To support this culture, Sitowise aims to commit its employees, and after the listing the company reached a broad employee ownership with over 1,000 employee owners.

Strong Historic Growth, High Margins and Strong Cash Flow

Sitowise’s net sales growth has been historically strong, which reflects Sitowise’s strong track-record of acquisitions and organic growth. The compounded annual growth rate of Sitowise’s net sales was 12.9 percent between 2018 and 2022. Simultaneously, Sitowise has been able to sustain its high profitability of adjusted EBITA margin of at least 10 percent between 2018 and 2022. Sitowise’s net sales, EBIT, and adjusted EBITA margin development as well as low capex has resulted in a strong operating cash flow, which is illustrated by strong cash conversion of over 80 percent between 2018 and 2020. A strong cash conversion creates good prerequisites for continued strong growth, acquisitions and/or distribution of dividends.

Successful Platform That Can Be Leveraged in Potential Future Acquisitions

The Nordic technical consulting market is highly fragmented with more than 11,000 suppliers in Finland and Sweden alone. [4] Consequently, conditions are favorable for market consolidation. Sitowise has acquired more than 50 companies over the last ten years [5] and has thus significant experience in acquiring and integrating new companies into its organization. Sitowise has also demonstrated its ability to expand geographically through acquisitions in Sweden. The proven and well-perceived processes enable Sitowise to target growth through acquisitions also in the future.

- International management consultant analysis conducted in the fall of 2020 and commissioned by Sitowise.

- Utilization rate defined as billable hours in relation to total hours of attendance for all employees for the financial year ended 31 December 2022.

- 2020 annual budget, Finnish Transportation and Infrastructure Agency. Source: https://vayla.fi/tietoa-meista/tapamme-toimia

- Source: Statistics Finland. Number of companies with the following TOL codes: 71121, 71123, 71124 and 71125; Statistics Sweden. Number of companies with the following SNI codes: 71.121, 71.123 and 71.124.

- Including acquisitions carried out by Sito and Wise Group prior to their merger into Sitowise.